Residential property management platform offers quick, simple, efficient solution for managing overdue payments

— Samantha Ferreira, Head of Client Services, PayProp North America

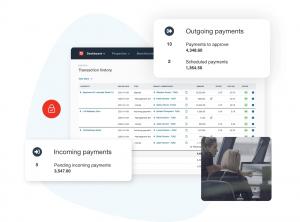

FORT LAUDERDALE, FLORIDA, UNITED STATES, April 8, 2024 /EINPresswire.com/ — PayProp, the automated rental payment platform for residential property managers, is excited to announce its new arrears fee billing feature, available to all PayProp users in the United States.

Property managers will have greater control over late payments and improved cash flow thanks to this game-changing addition to PayProp’s end-to-end rental payment automation platform. PayProp already enables users to send automated payment reminders to late-paying renters, and adding automated arrears fee billing gives investors another line of defense against defaults.

The arrears fee billing feature automatically calculates and applies fees to overdue payments based on flexible rules set by the property manager. PayProp users can choose a billing start date, add a percentage or fixed charge, and specify whether their business or the property owner should receive the fees. PayProp cautions that late fees billing must comply with local regulations regarding how, when and who receives arrears fees.

By streamlining the payment recovery process, property management businesses can redirect valuable resources towards core operations and growth initiatives, while incentivizing prompt payment and improving landlord and property manager cash flow.

“At PayProp, we constantly strive to make property managers’ work easier by automating as much of their payment administration tasks as possible,” says Bruce Jackson, PayProp’s Chief Technology Officer. “We are confident that the arrears fee billing feature will save you time and allow you to focus on your business’s real priorities, rather than on time-consuming payment administration.”

Samantha Ferreira, Head of Client Services at PayProp North America, is excited about what the new feature represents: “With each new feature, PayProp continues to enable the property management industry and add value through innovative solutions that empower businesses.”

UNRIVALED INNOVATION

Bank-integrated payment automation with PayProp enables property managers to cut their portfolio administration time to a fraction and allows them to focus on business development and managing more doors. As a result, PayProp’s North American clients grow more than 20% on average in the first full year of processing on the platform.

The platform automatically generates bulk rent and other invoices ready for approval and sending from the platform. Once payment is received, it lets property managers reconcile bulk incoming payments, automatically calculates management fees, and pays owners and contractors – all in just a couple of clicks.

Key features of the PayProp platform include:

– Automated reconciliation of rent payments to properties;

– Set-and-forget payment rules for multiple recipients across entire property portfolios, enabling bulk settlement in a few clicks;

– Strict user permissions, access control, and full audit logs to ensure the safety of client funds;

Arrears flagged in real time and missed payments recovered with automated reminders to late-paying tenants, along with automated, compliant arrears fees billing;

– Live management reports for property managers to check the financial health of their portfolios and benchmark themselves against competitors;

– An Owner app that enables owners to view always-accurate account totals with the most up-to-date status of their portfolio’s balance;

– A Tenant portal that allows tenants to view their entire invoice and payment history, make fast online bank transfers, and request maintenance services; and

– An application programming interface (API), which allows property managers to access PayProp data through other PropTech solutions.

ABOUT PAYPROP

PayProp is an automated rental payment and reconciliation platform for the property management industry. Launched in 2004, the company has grown quickly to become a leading processor of rental payments for residential properties, and today serves a large and diverse customer base of property professionals, processing $2.7bn in rental payments annually. The platform sets the standard for speed and accuracy of payments as well as cost and payment status transparency, offering customers complete transactional control and regulatory compliance.

On December 4, 2023, PayProp and Reapit announced that the two companies were merging. The combined company will offer clients the opportunity to have a single provider that delivers capabilities across sales, property management, and trust account management.

Learn more at www.payprop.com and subscribe to the monthly PayProp Insights for news and analysis on the residential rental market.

Caitlyn Conville

PayProp

[email protected]

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

CASE STUDY: Find out how PayProp helped one client reconnect with his family, all while doubling his portfolio

![]()

Originally published at https://www.einpresswire.com/article/701684676/latest-proptech-innovation-payprop-introduces-automated-arrears-fee-billing-feature